cares act stimulus check tax refund

Loans are offered in amounts of 250 500 750 1250 or 3500. If you owe 1500 in federal income taxes and you get a 1000 tax credit your tax bill sinks to 500.

U S Expats Coronavirus Stimulus Checks Top Faqs H R Block

Were not accounted for in the budget most recently approved as of March 27 2020 the date of enactment of the CARES Act for the State or government.

. That basically just. Therefore the EIP is not adjusted against any refund out of your tax return for the year 2020. However there may still be people eligible for those checks or.

COVID-19 Stimulus Checks for Individuals. These are all different names for the same payment. The IRS says it is no longer deploying 1400 stimulus checks and plus-up payments that were due to qualifying Americans in 2021.

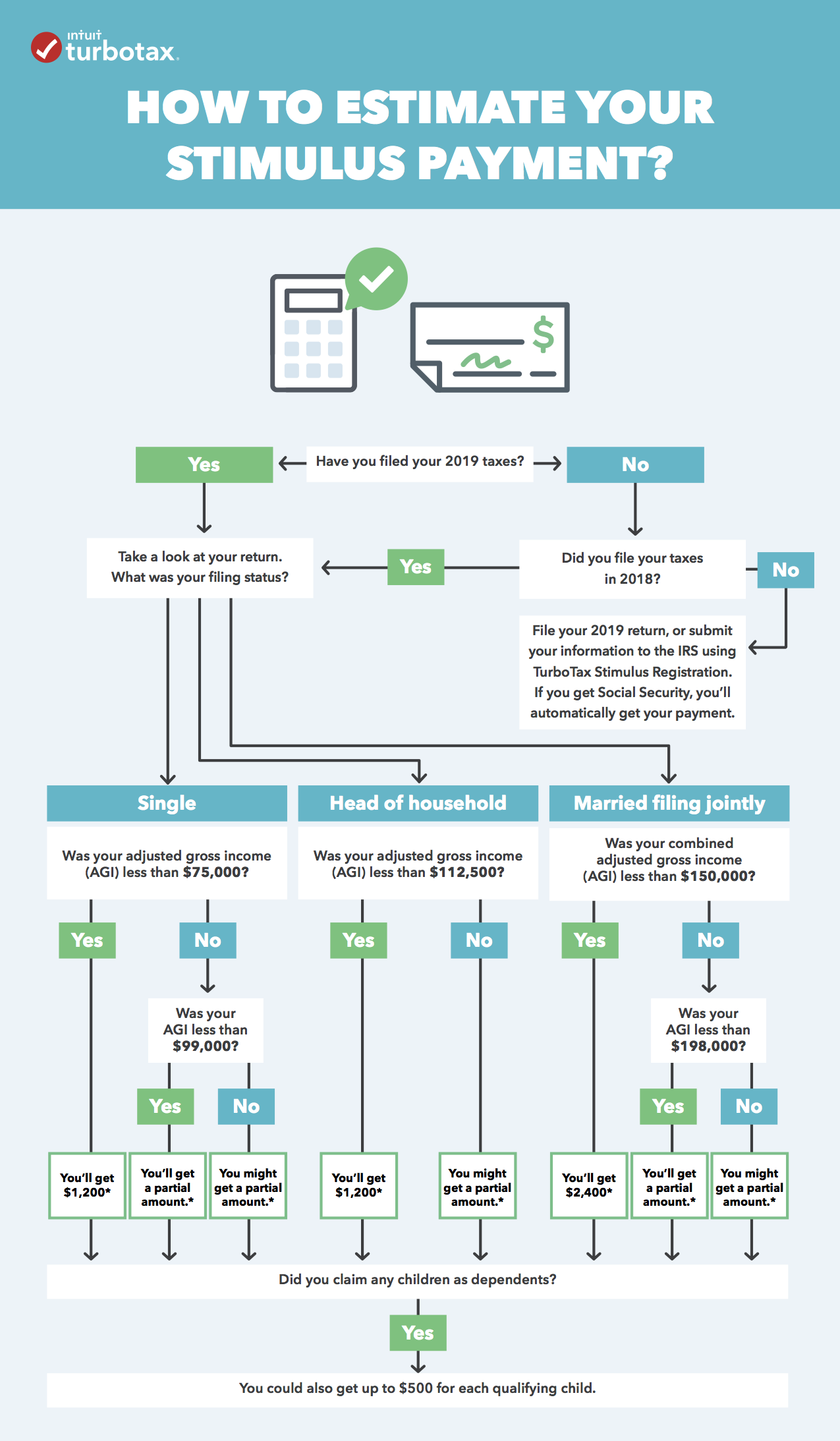

Many Americans are feeling the impact of the COVID-19 pandemic on their everyday lives. Married taxpayers will get 2400. People also call these payments Economic Impact or Recovery payments.

FAQs Regarding Stimulus Money You Received Under the CARES Act. The IRS has issued all first second and third Economic Impact Payments. It is not your tax refund.

Congress last year allowed states to block the first stimulus payment to people who owed child support. Mike Parson said he was supportive of using that approach. The CARES Act provides that payments from the Fund may only be used to cover costs that Are necessary expenditures incurred due to the public health emergency with respect to COVID19.

But thanks to the Families First Coronavirus Response Act FFCRA and the Coronavirus Aid Relief and Economic Security CARES Act you might see some relief when you file your 2020 taxes taxes filed in 2021. The CARES Act gave a maximum 1200 per person. Under the CARES Act losses that would have cut a companys taxes at some undetermined point in the future by 21 cents on the dollar are now worth tax refunds at 35 cents on the dollar.

This is an optional tax refund-related loan from MetaBank NA. We mailed these notices to. Because youre getting what amounts to a refundable tax credit now in the form of a third stimulus payment rather than waiting to get the money from the credit in 2022 when you actually file your 2021 tax return.

CARES Act I did not receive my stimulus but the IRS says I did. The irs online wheres my refund service does not. Yes the one-time stimulus payments stemming from the CARES Act are technically advanced refunds on a tax credit that qualifying taxpayers will receive for 2020.

The first round of stimulus checks mandated by the Coronavirus Aid Relief and Economic Security CARES Act was signed into law in March 2020. Most eligible people already received their Economic Impact Payments. The CARES Act passed by US.

So it does not form part of your taxable income for the year 2020 filing tax return in 2021. CARES Act Stimulus Payments. The CARES Act gave a maximum 1200 per person and 500 per eligible dependent child under 17.

Securely access your individual IRS account online to view the total of your first second and third Economic Impact Payment amounts under the Economic Impact Payment Information section on the Tax Records page. Missouri Intercepts 78 Million In Stimulus Money From People Who Owe Child Support. Like old NOL rules taxpayers can elect to forgo the carryback period and instead carryforward.

This payment was to help mitigate some financial burden. The government has deployed most of the third round of stimulus checks in amounts of up to 1400 per person. Track Stimulus Payment Recovery Rebate Credit Worksheet Explained.

The CARES Act created a new tax credit for taxes that will be due on income earned in 2020 but its available to eligible individuals now. To find the amounts of your Economic Impact Payments check. But when they file for 2019 and 2020 they will.

We break down the major changes that could impact your 2020 tax. 2020 and 2021 Economic Impact Payments Stimulus Checks. Help with CARES Act tax questions for your small business.

People who are missing stimulus payments should review the information on the Recovery Rebate Credit page to determine their eligibility to claim the credit for tax year 2020 or 2021. The plain and simple answer to that question is that stimulus payments are tax-free. Check out our Small business stimulus and tax relief page for the latest information.

The internal revenue service said on wednesday that it had delivered 90 million payments valued at 242 billion in its first batch of checks while the irs created this portal last year for the 1200 stimulus checks directed by the coronavirus aid relief and economic security or cares act. The CARES Act made the following changes to the NOL rules. For example if you owed 1000 in taxes but had a refundable tax credit of 1200 youd get a 200 tax refund check from Uncle Sam.

Payments were limited by 2019 or 2018 income as reported on federal income tax forms. 1400 in March 2021. Tax season is here and there are many things you need to be.

When the CARES ACT passed taxpayers were informed they would be receiving a stimulus payment of up to 1200 for single filers 2400 for joint filers plus an additional payment for those who had dependent children. In 2020 and 2021 the government sent sending stimulus payments to most taxpayers and their families because the Coronavirus caused so many people to lose their income. What do I do.

Receipt of stimulus payment does not increase your total income thus. For net operating losses NOLs generated in tax years beginning after December 31 2017 and before January 1 2021 taxpayers can carry such losses back to the 5 th year preceding the loss year. Despite stimulus money not being taxable you may notice that if you got that money already it may appear to reduce your tax refund.

This individual should receive a stimulus payment of 1200 immediately because the IRS will use their 2018 filing data in absence of a 2019 return. How can I claim the additional stimulus money for my qualifying dependents if I never received it.

How To Claim A Missing Stimulus Check

How The Recent Stimulus Checks Affect Your Ssdi Benefits Call Sam

Nonresident Guide To Cares Act Stimulus Checks

Federal Aid In 2022 No More Stimulus Checks In Sight Child Tax Credit Payments Expired Abc7 Chicago

Your 2020 Stimulus Check How Much When And Other Questions Answered

Will The Stimulus Money Be Deducted From Your Refund Next Year 9news Com

Incarcerated Are Entitled To Stimulus Checks Federal Judge Rules Again The Washington Post

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Where S My Third Stimulus Check Turbotax Tax Tips Videos

Third Stimulus Check When Could You Get A 1 400 Check In 2021 Irs Money Sign Prepaid Debit Cards

How College Students Can Get Stimulus Money The Washington Post

All You Wanted To Know About Those Tax Stimulus Checks But Were Afraid To Ask

Trump Demands Congress Raise Second Stimulus Check From 600 To 2 000 Under New Covid Relief Bill

How To Estimate Your Stimulus Check Infographic The Turbotax Blog

Stimulus Check Information Cares Act Crosslink Tax Tech Solutions

Stimulus Payments May Be Offset By Tax Debt The Washington Post

Key Dates For The Next Set Of Stimulus Payments The Washington Post

Filing Your Taxes Soon Here S How Covid 19 Stimulus Could Affect What You Owe

How To Claim Missing Stimulus Payments On Your 2020 Tax Return